UHD / Academic Affairs / Marilyn Davies College of Business / Graduate Programs / Master of Professional Accountancy | UHD Marilyn Davies College of Business / CPA Evolution

CPA Evolution

CPA Exam Information

Information for Candidates & Students

- The Texas State Board of Public Accountancy (TSBPA) eliminates the requirement for CPA candidates to take at least 15 of their 30 hours of upper-division accounting courses as in-person classes. (3-12-202s)

- Prometric will no longer require CPA candidates or test center personnel to wear masks unless required to do so by building management or local government mandates. (5-1-2022)

- The Texas State Board of Public Accountancy (TSBPA) accepts electronic transcripts

for Application of Intent. Ask your Registrar to send your electronic transcripts to: transcripts@tsbpa.texas.gov.

- Approved accounting research and analysis or tax research and analysis courses, and also accounting communications or business communications course. See the updated list from TSBPA..

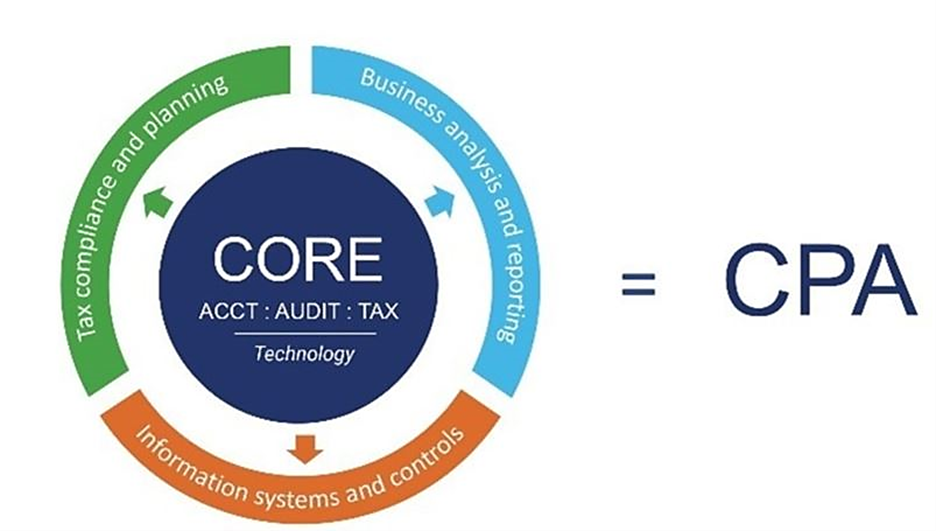

New Model for Licensure, New CPA Exam Launched 2024

- Transition policy announced for the 2024 CPA Exam (2-2-2022). Frequently Asked Questions are available that might answer some of your more detailed questions regarding the newly released transition policy.

- Additional information and FAQs regarding the CPA Evolution initiative are available at EvolutionofCPA.org.

If your questions on the new CPA licensure model, examination, and transition policy are still not answered, please reach out to us at Feedback@EvolutionofCPA.org. (Information has been obtained from this webpage: https://www.tx.cpa/resources/become-a-cpa/exam-providers)

Watch the Evolution of the CPA Exam from www.evolutionofcpa.org.